Client – Leading Multinational Bank

Introduction:

The client is the back office division of Standard chartered back worldwide. They handle a wide range of value-added and complex services from Banking Operations to supporting global HR processes, Finance and Accounting services, Software Development and maintenance, and providing IT Service and Helpdesk support and customer service support to the Group globally. They employ 10,000 people in various back office and call centres across the world from 70 locations.

The challenge:

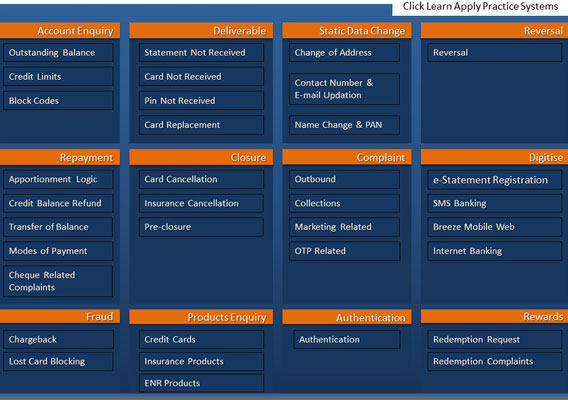

The client banking operations division wanted create an e-learning based induction program for new joins to train then in their complex credit card transaction application system.